The vast majority of SMEs interviewed think of conflict primarily in terms of direct physical threats to personnel and assets. The underlying causes of fragility and the legacies of (in many cases recurrent) conflict appear to be institutionalised and to shape an environment of general uncertainty. As such, they are generally perceived as regular circumstances, rather than a state of emergency clearly distinguishable from non-fragile settings.

However, when asked about their daily challenges, entrepreneurs offer a wealth of anecdotes that contain elements generally associated with fragility, including the role of mistrust and social relations and the interaction with competing systems of power.

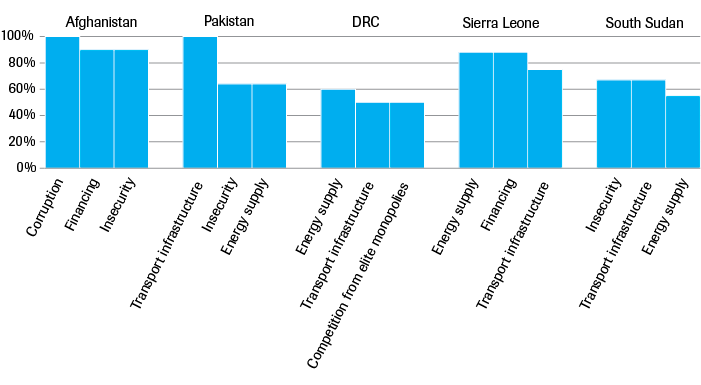

The type and relative significance of business constraints identified in the OnFrontiers and RVO surveys largely coincide with the SME barriers acknowledged in conventional business environment reports such as the World Bank’s Doing Business reports. The main bottlenecks are insecurity, deficient transport infrastructure and lack of energy supply.

Qualitative (anecdotal) evidence confirms the argument in recent literature that business behaviour is largely shaped by non-formal institutions, including social networks and non-state governance structures. Public authorities tend to collude with these informal structures.

A significant share of surveyed businesses (notably in Afghanistan, Pakistan and South Sudan) has developed strategies of resilience rather than growth in order to keep operating despite insecurity and unpredictability. Only in less insecure and more predictable settings (Sierra Leone and Kinshasa in the DRC) did some interviewed businesses describe clear growth strategies.

Many entrepreneurs rely on (clan- or ethnicity-based) social networks to cope with and overcome issues of insecurity and access. Having a friend in the right place determines whether, and at what price and pace, an entrepreneur obtains permits, receives capital, or accesses raw material. Conversely, a businessman’s loyalty to these networks is expressed through the provision of employment opportunities, access to basic services such as health care, and charity.

Most interviewees engage with non-state actors and governance structures to be able to continue operations. This often involves more or less voluntary informal payments to both state and non-state actors in exchange for protection, safe passage, or access to resources or services such as electricity. Other forms of loyalty towards public authorities include offering company shares to local authorities.

How do SMEs perceive the conflict-affected environment in which they operate and to what extent do they feel affected by and (un)able to influence this environment? By answering these questions on the basis of two sets of data, the objective is to fill a twofold gap. First, the subsequent analysis primarily draws directly on the perceptions of small firms, interviewed for this purpose in the context of their business operations and with a particular focus on qualitative information. Perceptions of local entrepreneurs matter because, whether accurate or not, they are critical in understanding the interaction between the entrepreneurs and the broader context.

Second, what further distinguishes the following information from other business surveys is the focus on the social and political structures that are likely to drive the more technical and commonly identified constraints. The analysis is driven by the hypothesis that understanding these structural underlying causes is critical for the development of realistic support strategies that start from where the entrepreneur actually stands.

The chapter will offer some qualitative insights into how SMEs and local experts perceive conflict and fragility dynamics (3.1), what they see as the major constraints on doing business in such conflict-affected or fragile contexts (3.2) and, finally, which strategies they adopt or see as most suitable in order to handle those constraints (3.3). The two fragility determinants introduced in the previous chapter – social fragmentation and hybrid governance – will be used as analytical tools to explore the underlying causes and connections.

2.1 SMEs’ perceptions of conflict and fragility

Although the regions covered in this study differ greatly in type, intensity and legacy of conflict, the evidence reveals some patterns in SMEs’ perceptions of conflict and fragility and in the business interaction with acute or latent conflict dynamics.

Generally, when asked about conflict and fragility, SMEs think of overt violent confrontation and armed fighting. In fact, the concept of fragility currently so much in vogue with policy makers does not resonate with most entrepreneurs. What policy makers commonly agree to be fragile or conflict-affected for most entrepreneurs is just the given reality, in which they happen to operate and, in some cases, have been operating for many years. In that sense, their replies suggest that underlying factors of conflict have been institutionalised, both in formal and informal arrangements that constitute normal circumstances, rather than a state of emergency clearly distinguishable from non-fragile settings.

This becomes clear in the attempt of various respondents to localise and thus limit the conflict to a particular (remote) locality (e.g. eastern DRC) or to the distant past (e.g. the invasion of Iraq in 2003). For example, an entrepreneur in animal husbandry with plans to establish a joint venture in Kinshasa argues: “The distance between Goma, the main city in eastern DRC, and the capital Kinshasa is the same as between The Netherlands and Romania. Would you be afraid to do business in The Netherlands when there is trouble in Romania? Certainly not.”[30] This response illustrates that, aside from the physical distance between the centre and the periphery, the perceived – and to a certain extent de facto – absence of Kinshasa in eastern DRC attests to a lack of statehood or state legitimacy, which is one of the inherent challenges faced by entrepreneurs in that region.

Further illustrating the institutionalised character of fragility and conflict is the finding that corruption and insecurity are described by a majority of respondents as part of their interaction with the officials and formal state institutions that are meant to make society less fragile. More generally, an interviewee in Afghanistan explains conflict dynamics in his country as a result of an ongoing struggle for political power.[31]

Eighty per cent of interviewees feel their business is (somehow or heavily) affected by operating in a conflict-affected country.[32] First and foremost, almost every entrepreneur across the sample has experienced conflict as a direct physical threat. Illustrations range from–kidnappings, loss of assets and reprisals against communities hosting militias[33] to terrorist attacks.[34] Some business owners relate incidents of relocation and abandoned expansion plans due to immanent security threats to personnel and assets.[35] Entrepreneurs in South Sudan, for instance, report that the withdrawal of international organisations and the evacuation of foreigners have robbed many businesses of their customer base and/or employees. Interestingly, in a way these businesses had at first been affected positively by conflict, as it generated an influx of foreigners with their own demand and purchasing power. Security threats to assets and staff are further reported to put a strain on transport of goods and staff movement. For instance, in the Palestinian Territories, entrepreneurs report having to struggle significantly because of movement restrictions, emphasising how the closedown of border crossings seriously obstructs the import and export of their goods.[36]

Second, many entrepreneurs stress that the way they run their business is heavily influenced by political instability and the unpredictability of the future. Several SMEs in Pakistan and Afghanistan blame the absence of a stable political climate for the challenges their businesses have to cope with.[37] Conversely, an entrepreneur from Sierra Leone confirms that the improved political climate in recent years is the main reason for a more positive business outlook for his firm.[38] Some entrepreneurs and local advisers refer to the legacies of conflict they feel affect their business operations. A local expert in Sierra Leone stresses the large-scale displacement of people, the destruction of livelihoods and therefore limited purchasing power, and the lack of qualified and skilled people due to a disrupted education system.[39] Along the same line, a local expert from the DRC links SMEs’ lack of access to finance to a general culture of mistrust, disrupted information networks and the absence of legal enforcement as a long-term consequence of conflict.[40] The presence of the international aid community is also repeatedly mentioned by entrepreneurs and local advisers as a long-term characteristic of post-conflict markets, shaping both demand and prices in certain market segments served by local SMEs.

PSI+ managers confirm and complement the perceptions of SMEs. Comparing the conflict-affected business reality with the circumstances businesses face in non-fragile settings, these experts identify three features that differentiate fragile contexts from non-fragile ones:

The fact that personal connections matter more than formal permits;

A high level of political instability and uncertainty, associated with weak formal institutions;

Lack of security and/or quickly changing levels of security.[41]

While the two latter features coincide with the ways entrepreneurs see their economic activities being affected by conflict, the first issue was not identified as a constraining factor caused or reinforced by conflict and fragility. Instead, as we will see in the final section of this chapter, the significance of personal connections features prominently in SMEs’ coping strategies, a finding that again underlines the extent to which fragility has become part of entrepreneurs’ day-to-day reality.

2.2 SME constraints and their links to conflict and fragility

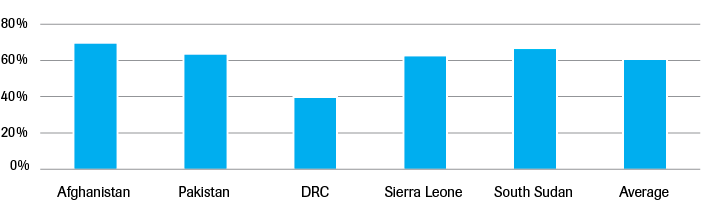

Entrepreneurs from both the PSI+ programme and the OnFrontiers survey identify similar key business bottlenecks as those put forward in conventional surveys. Entrepreneurs interviewed by OnFrontiers highlight the lack of energy (electricity) supply, deficient transport infrastructure and insecurity as major constraints[42], while RVO clients stress political instability and transport infrastructure as the most significant obstacles to their business.[43]

Source: Aggragated data, OnFrontiers SME survey data results

For the 22 fragile and conflict-affected states of the 181 countries included in the World Bank (WB)’s enterprise surveys, electricity emerged as the most important business barrier, closely followed by political instability. Additional top constraints that feature high in the WB’s enterprise surveys but less prominently in OnFrontier’s aggregated data are access to finance, informal sector practices, and corruption (WB, 2013b: 17 and WDR 2011: 176, f.n.69). Transport infrastructure (inadequate roads, rail, ports, frequent blockages) is not part of the relatively small set of Doing Business indicators (WB, 2013b: 25), but emerges as a key explanatory factor for high costs and the limited competitiveness of SMEs in fragile settings in the OnFrontiers survey.

As well as bringing this transport bottleneck to the surface, OnFrontiers also provides some qualitative data that reveal both underlying connections between seemingly different constraints such as political instability and infrastructure and the structural causes behind the more technical obstacles to specific business functions.

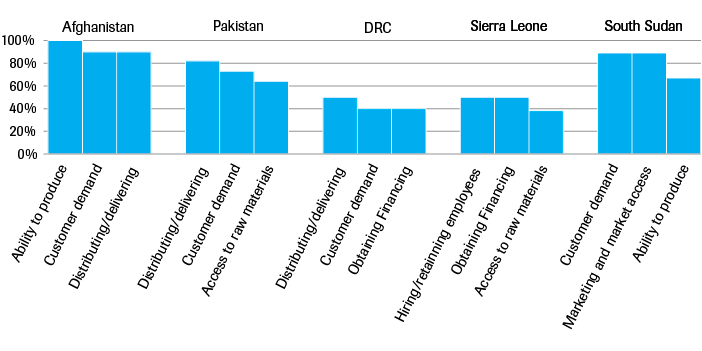

For example, the two most frequently cited business areas that interviewees feel were negatively affected are distribution/delivery of products and customer demand for goods and services. Qualitative data suggest a strong correlation between politically motivated (and therefore unexpected) roadblocks and general uncertainties about the future as being the primary causes behind those constraints. According to entrepreneurs, distribution problems stem from damaged transport infrastructure and roadblocks, which increase the cost of transporting goods,[44] while shrinking demand is believed to be caused by the uncertainty that conflict generates: people tend to be less ready to invest in products that can be stolen or destroyed if fighting recurs.[45]

Source: Aggragated data, OnFrontiers SME survey data results

Multiple links to social and institutional complexity emerge from respondents’ qualitative descriptions of the various technical obstacles they encounter. The following paragraphs offer some anecdotal evidence for each of those constraints.

In the following sections, quantitative findings regarding SME constraints are complemented with qualitative findings. In particular, insights provided by interviewed entrepreneurs and advisers are used to shed light on the connections between technical constraints and their social and political underpinnings. For this purpose, we focus on the five key constraints as identified by OnFrontiers (transport, energy, corruption, insecurity and financing) and complement these by also elaborating on two additional factors identified by interviewes (crime and competition from elite monopolies) which can be closely linked to the two themes, social fragility and hybrid governance, identified as key characteristics of fragile settings.

Insecurity – an opaque combination of government incapacity, government complicity, competing security providers and crime

While insecurity of personnel and assets is highlighted as a major obstacle by most interviewees, it is of much more concern in Afghanistan and Pakistan and surprisingly less of an issue in South Sudan, despite the resurgence and persistence of violent conflict since December 2013.

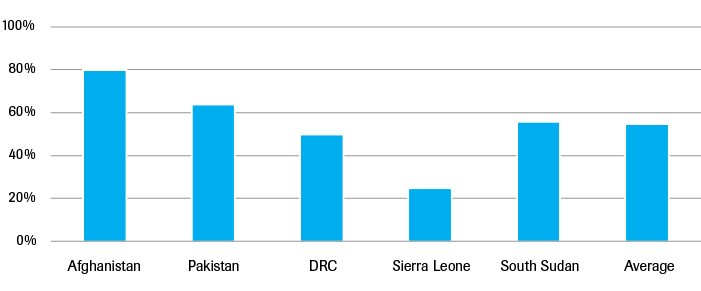

Source: Aggragated data, OnFrontiers SME survey data results

The reported impact of actual and expected insecurity is huge and ranges from relocation or interruption of operations to loss of assets and/or staff. Thefts from warehouses or from customers immediately after they have purchased goods are also reported as direct consequences of acute insecurity. Less directly, deteriorating security can prompt the disappearance or significant weakening of a customer base. This is mentioned, for instance, by businesses in Juba that primarily target the international community.[46]

Insecurity, as experienced by SMEs, appears to be not solely caused by the incapacity of state authorities to prevent crime and disorder and the presence of insurgents or criminals keen to exploit that weakness. What seems to reinforce and worsen the nature of insecurity in contexts where statebuilding proves to be an arduous and often contested process is the complicity and impunity of state security forces and the collusion of state officials with criminal gangs and insurgents.

RVO gives an account of an Afghan logistics company and its ways of dealing with insecurity:

“He (the entrepreneur) used to participate in convoys, paying private security firms to protect the lorries. He suspected that private firms had good relations with the insurgents and passed them money in exchange for safe passage.

Nowadays, the use of private security is prohibited and he has to pay the Ministry of Internal Affairs for protection by the army and police. This is more expensive and less effective.”

In addition, the competition between political parties and between formal and informal authorities, including religious leaders and warlords, is perceived to be a systematic threat. One Pakistani entrepreneur referred to this as “normal law and order”.[47] In Afghanistan, a logistics company explains that given the nature of its business, it is very difficult to secure operations in less familiar regions where personnel cannot rely on the two best security guarantees: tribal ties and local knowledge.[48]

Overall, the state is mostly described as an institution that not only fails to provide security but actively contributes to persistent insecurity, while entrepreneurs find more reliable and efficient security guarantees in social networks and non-state groups. Indeed, anecdotes from PSI+ recipients in Afghanistan testify to the fact that, in order to invest in or expand operations into contested (i.e. Taliban-controlled) regions, a business can only survive if it has solid kinship support or tribal ties in that region or if it manages to quickly establish material benefits for local authorities and their constituency.[49]

Transport infrastructure – either in poor condition or a source of informal taxation

Source: Aggragated data, OnFrontiers SME survey data results

Deficient transport infrastructure was ranked among the most severe business constraints across all countries covered by the two surveys. Coupled with security concerns, difficult transport conditions account for ‘distribution and delivery of products’ being one of the business areas believed to be most affected by conflict. As well as hindering physical access to markets, bad infrastructure affects SMEs’ competitiveness by prompting higher costs (e.g. due to the need for spare parts and repair),[50] delays, and quality or product losses (in the case of perishables).[51]

Whereas violent conflict can leave its physical traces in damaged road infrastructure, as was reported from Burundi, for example,[52] access to roads is also found to be deliberately hindered by road blockages and the closing of border crossings, as reported by an entrepreneur from the Palestinian Territories.[53] The apparent arbitrariness and unpredictability of these politically motivated hindrances tend to affect business even more, as they are difficult to be planned for.[54] As latest literature on bribes confirms, the unpredictability of corruption matters more than its size. Predictable bribes can be planned for regardless, to some extent, of their amount, while unexpected bribes are more difficult to be factored in and therefore foil business planning. Roadblocks may be politically motivated, as in the Palestinian Territories,[55] linked to crime, as reported from Pakistan,[56] or a combination of both when state authorities and criminal gangs collude. Obviously, infrastructure rehabilitation will not address these issues.

Energy supply – not a matter of getting a connection, but of accessing power

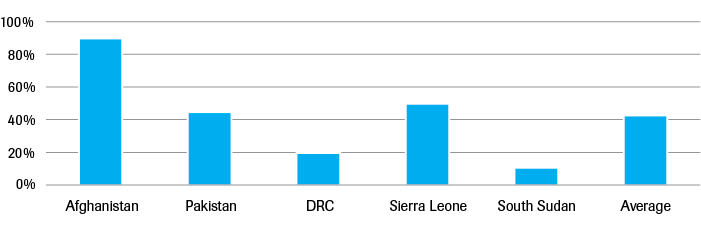

More than half of OnFrontiers’ respondents identify the lack of access to energy or unreliable power supply as a major bottleneck, with direct impacts on the production and storage of (perishable) goods, the business areas that 53% and 45% of interviewees report to be most affected. Yet, only just over one-third of respondents consider poor energy supply to be directly related to conflict.

While some businesses have resorted to buying their own generator as a back-up,[57] increasing fuel prices impede their regular use, which results in exorbitant production costs.[58] Given this reality, most entrepreneurs see the delivery of electricity as a core responsibility of government.

Source: Aggragated data, OnFrontiers SME survey data results

As a matter of comparison, it is worth noting that in her political economy analysis of the electricity sector in Lebanon, Stel reveals various incentives of political elites to grant or deny access to power. She decries the WB’s Doing Business report for not capturing de facto access to power, but merely registering de jure access through an electricity connection. In a careful analysis of political and economic patronage networks, she then demonstrates how the distribution of electricity is used as a means to give priority treatment in exchange for political support or material gain. Competition within government authorities and a general lack of transparency and accountability within government structures, as routinely encountered in fragile states, offers a fertile ground for such practices.

A local expert in Pakistan explains the lack of reliable energy as a by-product of the political/ethnic conflict between the five major provinces. He links prevailing inter-regional tensions to competing interests within the government, which translate into favouring one ethnic/political group over another – for instance, through access to more reliable energy provision.[59]

Limited access to finance and issues of trust, corruption and collusion

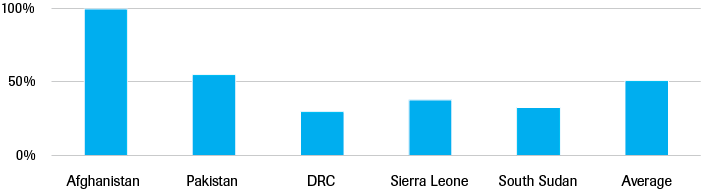

Lack of or limited access to finance is seen as a ‘frequent’ or ‘severe’ bottleneck by at least half of the entrepreneurs in Afghanistan and Sierra Leone. In both countries there is some agreement among most interviewees that this constraint was (partly or primarily) to be blamed on conflict. In fact, respondents link the lack of unaffordable finance to the “lack of investor confidence” and to the “political uncertainty”.

Source: Aggragated data, OnFrontiers SME survey data results

Although mistrust within and between communities and vis-à-vis the government was not identified as a significant impediment to businesses,[61] issues of distrust feature in many anecdotes used to illustrate the technical constraints, such as access to finance, encountered by SMEs. For instance, an entrepreneur in South Sudan explains that access to capital is a matter of either having a wealthy relative or an uncle in the right place.[62]

Another compelling example of deficient financial services is the report of an entrepreneur who relates how SMEs’ suffer from the entanglement of financial institutions with organised crime:

“One time a member of our staff went to withdraw money from the bank and someone from within the bank informed some thieves that he was withdrawing a lot of money. He was kidnapped right in front of the bank. Now we deposit funds with money dealers, which is safer.”[63]

Such anecdotes underline that finance is not only a technical bottleneck due to “unbanked areas”, “unaffordable services” or “a lack of collateral”,[64] but also the result of “lack of trust, networks and legal enforcement”.[65] Hence, social fragmentation and unaccountable governance structures are likely to stymie access to finance even where it is technically available to SMEs.

More generally, entrepreneurs confirm that, as obvious beneficiaries of financial assistance, they would typically become more vulnerable to extortion.

Corruption - an integral part of state-business relations

More than half of SMEs interviewed consider corruption (e.g. patronage, exchange of goods and services for political support) to negatively affect their operation. Even in countries where interviewees are optimistic about the general business outlook for the next three years, respondents are the least positive about corruption trends, with one-third of interviewees believing that the issue will remain the same or get worse in the near future. While most business constraints are perceived to be driven by conflict and expected to improve in the years ahead, in many cases corruption constitutes the outlier, with many respondents seeing corruption as independent of conflict and likely to remain the same or become more of a concern in the next three years.[66]

Source: Aggragated data, OnFrontiers SME survey data results

A possible explanation for this is the fact that corruption dynamics in fragile societies may indeed be similar to those in non-fragile polities. However, as recent literature suggests, where state legitimacy needs to be rebuilt and high levels of mistrust and poverty prevail, corruption tends to intensify and entrench itself in social structures (Lindberg&Orjuela, 2014: 724). As a result, the (short-term) cost for individual businesses in not responding or engaging in corruptive practices is much higher than the cost for complying with the system (Rothstein, 2014). Indeed, illustrations of corruptive practices range from incidental corruption for the personal gain of individual state officials, to structural corruption and entrenched patronage systems involving public authorities and businesses, along with other non-state actors such as warlords and criminal gangs.

With South Sudan ranking 173 out of 177 in Transparency International’s 2013 corruption perceptions index and the DRC also scoring very high (154/177), it is striking that entrepreneurs in both countries do not perceive corruption as a major obstacle to their business, and that one-third of South Sudanese respondents and almost two-thirds of businessmen in the DRC state that corruption would not affect their operations at all.[67]

The picture looks quite different in Afghanistan, which is also at the top of Transparency International’s corruption perceptions index (175/177). None of the interviewees denies the negative impact of corruption on business. Interestingly, in Afghanistan and Pakistan, where more than half of interviewees perceive corruption as a major bottleneck to their business, a large majority of respondents believes the conflict to be a driver of this impediment.[68] One of the advisers interviewed in Kabul estimates corruption to outpace government revenue by 100–200%.[69] In fact, an Afghan business owner concludes that corruption is so endemic within the government that the latter cannot be expected to address the problem.[70] This statement challenges the prevailing policy stance on corruption, which political analyst Mungiu-Pippidi describes as the ‘principal-agent approach’ in which higher authorities such as ministries and enforcement agencies are assumed to have the moral and technical supremacy to contain corruption.[71] In reality, as the responses indicate, those higher instances are typically found to maintain and reinforce corruption as a means to retain and expand power.

Furthermore in some instances, entrepreneurs lament the fact that local law enforces act in collusion with local gangsters who break into warehouses for theft and use the incident for racketering.[72] Bigger companies with more resources are perceived by SMEs to have a competitive edge when bidding for government contracts, as government officials have an interest in gaining political support from those companies and their constituencies (including customers, suppliers, employees, etc.).[73]

“Mafia businessmen (…) are getting the opportunities from the government, while the large majority of firms doesn’t get a chance to receive contracts from the Afghan government or the international community.”[74]

The same kind of collusion between political and economic leaders occurs on the side of competing authorities such as the Taliban in Pakistan who were expected to selectively promote business growth among their own business clientele: “The Taliban are more likely to favour business growth to empower their own people.”[75]

To conclude, corruption and clientelism are commonplace in the fragile societies that are the subject of this study.[76] Entrepreneurs conceive it as both a constraint and an integral part of doing business. On the one hand, not only does corruption in government offices “waste SMEs’ time and money through long bureaucracy”,[77] it also, and more importantly, impedes SME growth by systematically favouring political protégés over less well-connected small firms, punishing growth through further extortion, and increasing the burden of crime on those firms that have the least resources to protect themselves. On the other hand, many entrepreneurs readily admit that corruption has become a necessary evil in their daily business operations, be it to secure safe passage, obtain a licence to operate, or to build legitimacy and trust with the host community.

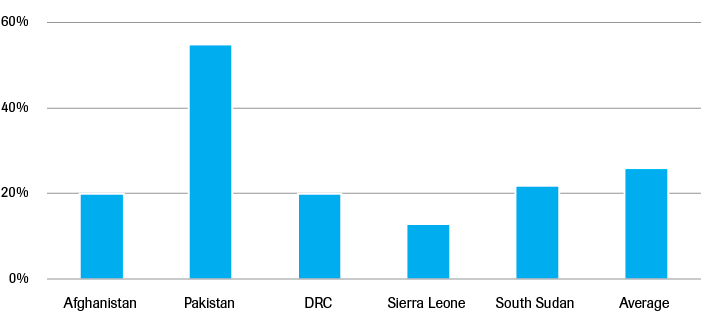

Community mistrust - Social connections defining business constraints

Close to one-third of SMEs interviewed by OnFrontiers felt that mistrust between individuals, businesses or groups did negatively impact their business with more than half of the entrepreneurs in Pakistan stressing this as a burdensome hindrance to doing business, while in Sierra Leone only 13% of business owners felt their business was affected (and never severely). Similarly, when asked in more detail about the specific business areas most affected by conflict, “community relations” were highlighted by one-fifth of interviewees.

Businesses in Pakistan said they face suspicion from surrounding communities and stressed the importance of adhering to cultural and religious norms and values as a basis for doing business.

Source: Aggragated data, OnFrontiers SME survey data results

For example, while smoking and the use of the prophet’s name for marketing purposes had reportedly caused distrust,[78] hiring a disabled employee and keeping a modest appearance in public prompted greater acceptance within the community.[79] This applies as much to entrepreneurs as to financial service providers. One respondent points out that any financial services will have to appeal to an Islamic mind-set in order to meet a demand.[80]

A concrete example of social fragmentation comes from Afghanistan, where an SME brought its labour from the North province to start operations in Khost province:

But residents in Khost “did not allow us [the company] to use staff from the North” and the company had to recruit new staff from the locality.[81]

In terms of social acceptance, women entrepreneurs and young people are said to face social barriers. For instance, in Pakistan women entrepreneurs are perceived to face additional obstacles, as the more lucrative business locations are usually reserved for older and established businessmen. Young entrepreneurs or women need the elders’ consent and support to access those markets. More generally, it is reported to be harder for women to start businesses in rural areas, where entrepreneurial women are less accepted within local traditions and culture.[82]

Lastly, as mentioned in the paragraph on insecurity, tribal ties can greatly ease operations in unsafe areas, just as hiring employees from the local community or securing local people’s loyalty to the business (through employment or charity) is said to be critical for a business to survive in a fragile society.

2.3 Business strategies: between coping and growing

The link between business and the environment is not unilateral. Whether entrepreneurs act in reaction to the constraints and opportunities they perceive or whether they operate in anticipation (or ignorance) of the risks and possibilities that are likely to occur, their operations also have an impact on the broader economic, social and political environment. Any business strategy will therefore affect existing power balances and struggles.

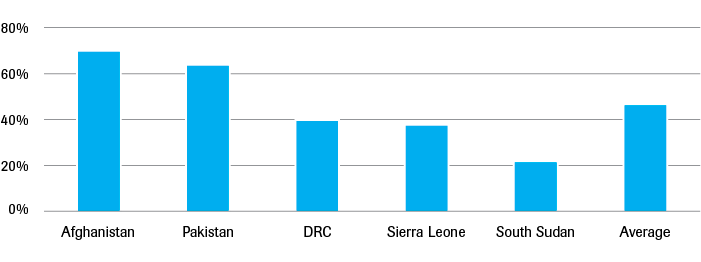

To shed some light on the multiple ways in which SMEs affect their surroundings, the OnFrontiers and RVO surveys explore firms’ coping strategies and their priorities for potential external assistance.[83]

SMEs’ response strategies to conflict or fragility-related obstacles

In general, direct security threats and long-term uncertainty are two key factors shaping small firms’ behaviour in fragile settings. In response to direct security threats, SMEs across all countries confirmed significant investments in security measures, e.g. by equipping production sites and warehouses with surveillance cameras, alarms and security guards (Pakistan, South Sudan) or even using armoured vehicles (DRC). How long-term uncertainty shapes SMEs’ strategies depends on the degree of optimism about the general business outlook. Where the level of conflict is expected to deteriorate over the next three years (e.g. Afghanistan, Pakistan and, to a lesser extent, South Sudan[84]), economic (long-term) efficiency takes a backseat and entrepreneurs’ coping mechanisms are aimed primarily at resilience. In places where there is more confidence in the future, entrepreneurs take a less risk-adverse, more adventurous stance.

Overall, the following traits of business behaviour can be distilled from all the interviews.

a) Avoiding and mitigating risk: business strategies aimed at resilience rather than growth

“We need to plan for distribution routes which are less prone to conflict; open stores where the situation is likely to remain stable. However, all this increases costs.” (Interview with business owner in Pakistan)

Many respondents in Pakistan, Afghanistan and South Sudan report their operations to be on hold due to an uncertain future. Whether waiting for the outcome of contested elections or the impact of the withdrawal of international troops (Afghanistan), whether in expectation of some progress in the ongoing peace talks and, hence, a return of evacuated employees (South Sudan), or in anxiety about follow-up actions in response to recent insurgency (Pakistan), most entrepreneurs in these countries have adopted a “wait and see” attitude and kept a low-profile, reluctant to plan for the future before the political situation improves. Avoidance of further losses and unnecessary risk appears to be the guiding principle in order to keep operations running.

Resulting coping strategies include the reduction of inventory and in-bulk purchases in anticipation of theft, sudden drops in customer demand[85] or arbitrary confiscations.[86] Another element of resilient business behaviour is the choice to serve only local markets in the immediate vicinity rather than exploring potentially more lucrative markets further away, as the latter would bring additional risks arising from unsafe distribution routes and an uncertain customer base.[87] A further common risk-averse strategy consists of favouring safe locations over strategically better-situated areas. Such preferences are reflected in the selection of warehouses, raw material providers, or points of sale.[88] All of these measures were explicitly described as economically less efficient, and coming at the expense of economies of scale, increased transaction costs and missed opportunities in terms of un-served additional markets.

Given that most of the firms interviewed in these countries have directly or indirectly experienced interruptions to their business operations,[89] their appetite for risk is generally low. The entrepreneurs interviewed seem to consciously choose a strategy of resilience rather than aspiring to growth.

By contrast, entrepreneurs in Sierra Leone and the DRC, where the general business outlook among interviewees was more optimistic, describe a coping strategy that aims at the highest possible degree of flexibility to be able to adjust to shifting markets. Examples include the purchase of raw materials in large quantities at minimum costs and the diversification of suppliers to avoid dependency on regions that might be hit by conflict.[90]

b) Community relations and clanship critical for SME survival

“There is a general sense of belonging and people are more likely to go to businesses that are from the same locality as them.” (Interview with local adviser in Pakistan)

The significance of business-community relations and businesses’ reliance on family, clanship and ethnicity was testified throughout the interviews and seems to be of particular importance in contexts marked by social fragmentation and mistrust. Both features influence SMEs’ strategic choices with regard to employment, investment location, sourcing of inputs, business linkages and transport routes.

Illustrating the importance of family relations, an Afghan paint maker reports that he is only able to operate in a highly contested region because he can rely on the provision of chalk from a mine owned by his brother’s family-in-law. In the same vein, an interviewee in South Sudan concludes that the “most important thing locally is whether you have a relative who can give you capital (…) It’s all about connections, about having the right uncle in the right place.”[91] Along the same lines, a logistics company says their main challenge is their lack of tribal ties to assure safe passage in many of the areas they need to cross.[92] In Pakistan, SMEs often operate in clusters that are based along ethnic lines. Whereas in the past such clusters used to cut across ethnic lines, current ethnic conflict and local extortion were reported to have caused the breakdown of some clusters along ethnic lines, destroying its competitiveness.[93]

Beyond ethnic networks, a positive relationship with the host community is also critical for SMEs to operate in highly fragmented markets. For example, in Pakistan an interviewee explains that there is a strong sense of belonging which prompts customers to prefer engaging with businesses owned by people from the same locality. This rule of thumb appears to affect SMEs particularly, and applies to a lesser extent to larger businesses.[94] A businessman in Afghanistan confirms that business expansion into a new locality entails an extra investment in trust building with the community; adhering to local norms of behaviour may not suffice. Direct benefits in terms of employment for the local population (often requiring additional investment in training) and additional favours such as access to health facilities[95] will be expected from a new business before community members consider becoming customers.

In response, entrepreneurs in the Palestinian Territories and Afghanistan stress that hiring locals has proved a successful risk mitigation strategy,[96] even though it generally requires additional investment in training. As well as creating employment opportunities for the local population, SMEs report undertaking special efforts to gain a social licence to operate in a given locality. Examples include giving discounts to customers “to make them loyal” (DRC)[97] and distributing material benefits and charity (Afghanistan).[98] In a broader sense, business strategies (notably in marketing) that fail to comply with religious and cultural values and norms in ethnically or religiously biased societies will trigger suspicion and ultimately rejection, a fact that can become a constraint or a source of innovation.[99]

Finally, anecdotes from the Gaza Strip reveal how good personal connections with suppliers or customers in Israel can significantly mitigate burdensome restrictions on movement across the border with Israel.[100] This example illustrates that personal connections and informal arrangements rather than institutional reforms are seen by entrepreneurs as a means to overcome a discouraging business environment.

c) Not a matter of choice: SMEs readiness to pay bribes to public officials, non-state authorities and local gangs

“To operate, businesses have grown immune to organised crime and corruption and treat it as a cost associated with operation. The cost of loss of assets or cost of extortion money is included in the cost of business.” (Comment by data collector in Pakistan)

Whereas a significant proportion of respondents in South Sudan and the DRC does not list corruption as an obstacle to doing business, entrepreneurs and advisers in both countries readily admit to “paying bribes” and stress the need to “establish good connections with public officials” as a prerequisite for doing business.[101] Rather than being seen as a problem, corruptive practices are primarily perceived and presented by entrepreneurs as a solution, a means to overcome security threats and obtain services that dysfunctional formal institutions are unable or unwilling to provide. Only businesses that cater mainly for the international community (e.g. a logistics company working primarily for the International Security Assistance Force in Afghanistan) are thought to be in a position to refrain from working with a corrupt government given their financial interest “to keep a clean image vis-à-vis international donors”.[102] The reality of most SMEs demands greater readiness to compromise, as they simply lack the political clout to oppose such common practice. Many entrepreneurs across all countries report that they commonly experience extortion by both state officials and criminals, to the point that average extortion fees are factored into production costs.[103] In the case of business expansion, an entrepreneur argues that only by inviting the governor of the ‘new’ province to become a minor shareholder had the business secured his support.[104] At odds with this common reality, and mindful of the formal request for adherence to certain performance standards, most applicants for the PSI+ grant assert that they have a zero-tolerance approach to corruptive practices.[105]

SMEs’ readiness to bribe public officials also applies to competing non-state authorities such as the Taliban in Afghanistan and Pakistan and traditional chiefs in South Sudan.[106] For instance, in order to start operations, a chalk ore company in Afghanistan explains that it has to follow three separate procedures involving a permit from Kabul, a social licence to operate from the local community (e.g. in the form of employment guarantees, free access to medical care) and a deal with the local Taliban commander. Although they are a heavy bureaucratic and financial burden for the business, such multi-layered arrangements enable the entrepreneur to operate in the here and now. However, they leave the business in a vulnerable position in the medium to long term. A shift in power can close the area down and nullify the agreements, leaving the entrepreneur with obsolete hardware.

In many cases it is the immediate need for security of assets or personnel that prompts SMEs to seek protection arrangements. This often means that they end up supporting patronage networks – either by directly paying informal security taxes to state officials[107] or competing non-state authorities, or by paying extortion fees to local gangs/insurgents who are likely to be linked either to government or to a contesting entity. In doing so, SMEs obtain security provision in the short term, while reinforcing structures of long-term uncertainty.

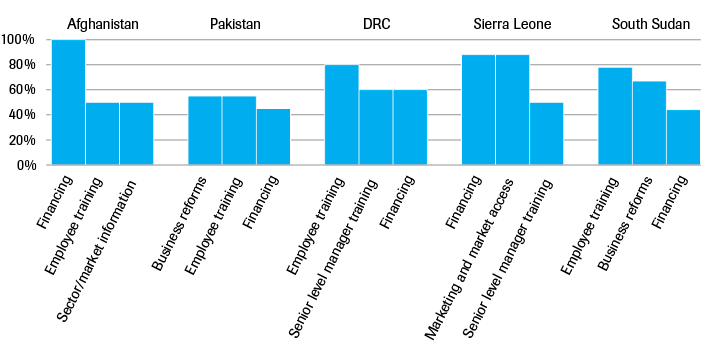

Expected support

When asked about the kind of support SMEs would welcome as most useful, access to finance and training of employees are mentioned most often. Strikingly, these two areas of support do not rank highest among the business bottlenecks identified by interviewees. But they do match quite closely with what donors and their development implementers usually have on offer. Another explanation for the mismatch between constraints and expected support lies in the common assumption that governance and infrastructure concerns would need to be addressed by the respective government, not by a donor or NGO.

Source: Aggragated data, OnFrontiers SME survey data results

Perhaps more importantly, it is striking that the investment plans that interviewees draw in the hypothetical anticipation of funding clearly do not quite align with their present coping strategies. While the large majority, certainly in Afghanistan, Pakistan and South Sudan, primarily pursue risk-averse consolidation strategies aimed at resilience and survival, the hypothetical prospect of funding prompts them to design strategies of growth and expansion. This triggers two questions: first, to what extent is this discrepancy between SMEs’ resilience strategies and suggested growth ambitions the result of commonly pre-designed donor support packages? Second, are there any risks (with regard to stability and peace) when encouraging SMEs in fragile contexts to switch from resilience to growth in order to receive support? The next section will discuss these questions in greater detail.