Introduction

The Euro would have been the crown upon the European internal market and a symbol for European unity. Already in its inception, economists were skeptical about the ability of the newfound Economic and Monetary Union (EMU) to absorb economic shocks and develop resilient institutions in case of economic crises.[22] Thinking about the EMU is dominated by the theory of Optimum Currency Area (OCA) with its prerequisites of (fiscal) risk sharing, capital mobility, labour mobility and business cycle synchronization.[23] In line with that, prominent economists are currently arguing that the EMU needs to further integrate, break apart, or anything in between (e.g. a differentiated Euro).[24] [25] [26] One way or the other there appears to be a consensus that the EMU in its current state is not resilient. With an ambitious deepening of the Eurozone now on the agenda, we once more see an old divide over the order of deepening EMU first or whether first convergence should take place.

Several recent papers[27] have argued that economic convergence has not sufficiently taken place in the EMU. Large (institutional) differences remain in key areas. Nevertheless, some progress has been made, notably in current account balances and the government balances.[28] However, an accommodating monetary policy has undoubtedly contributed to improving these balances, thereby questioning the structural recovery of European economies. On December 6th, the European Commission has launched its EMU policy package.[29] Initiatives such as the launch of a European Monetary Fund (EMF) and the introduction of a European economy and finance minister are initiatives in line with the idea that deepening of the EMU would increase its resilience.[30] In the meantime, despite optimism and calls for momentum, the reform drive of Southern member states has abated and the fundamental health of certain Eurozone economies remains disquieting.[31]

This calls for an assessment on the need of convergence by identifying the underlying mechanisms and initiatives currently in place that would induce convergence. In other words, the type of deepening economic governance as is now on the agenda may not solve the lack of convergence, and might (again) too swiftly lead to the conclusion that a leap forward is necessary. Current policy discussions would benefit from a stronger diagnosis on the issue of convergence and the need for a multi-level institutional toolbox. This short contribution aims at assessing to what extent convergence has taken place in recent years. In doing so it will pay particular attention to convergence indicators related to economic structures and the functioning of labour markets and capital markets, that according to OCA are key components of a well-functioning monetary union.

Analysis: convergence in economic structures

The concept of convergence is buzzing around in policy discussions on the EMU. However, types of convergence as well as their indicators are interrelated and as such often entangled in discussions on (the need of) convergence. In a literature review on the concept of convergence three main types of convergence can be identified: real, nominal and cyclical convergence.[32] The discussion of convergence and resilience of the EMU is often limited to convergence on income (real convergence) or government balances (nominal convergence). The idea that nominal convergence (in the form of the Maastricht criteria) would lead to real convergence (income convergence) has been highly criticized and a search for alternative solutions and an alternative agenda is well under way. In light of that, an important fourth category is gaining ground, i.e. convergence in economic structures.[33] That is not to say convergence in the other categories is not desirable, far from it, but they seem to neglect national economic institutions, and instead tend to focus on output rather than institutions (in the broad sense) and related (effective) policies. Convergence of economic structures implies a more direct focus on the fundamental health of national economies and the role of the EU and its internal market. Resilient economic structures would prevent macroeconomic imbalances and would be more capable of addressing economic crises. In addition, a well-functioning European market would provide important, if not essential, shock absorbers through increased capital and labour mobility.

This contribution distinguishes between national institutions and government finances, representing national economic institutions and environments on the one hand and internal market indicators on the other. An important aspect of a well-functioning monetary union is the ability for markets to absorb part of the economic downturn, for example through capital flows or labour mobility. Apart from more open capital and labour markets, it requires good national institutions and a stable macroeconomic environment. As such, this contribution examines these (national) economic structures by looking at five indicators of the Global Competitiveness Index (GCI): the quality of institutions; macroeconomic environment; financial market development; goods market efficiency; and labour market efficiency. The GCI measures the competitiveness of 137 countries along the lines of twelve policy domains with over 150 components. It does so by conducting surveys among experts, in combination with data selection from databases such as the IMF and the OECD. The selection made here is far from providing a comprehensive set of indicators to assess the degree of convergence or competitiveness, the selected indicators give a first glance at the economic structures and the development of important market functions of several Eurozone member states.

Quality of national institutions and government finances indicators

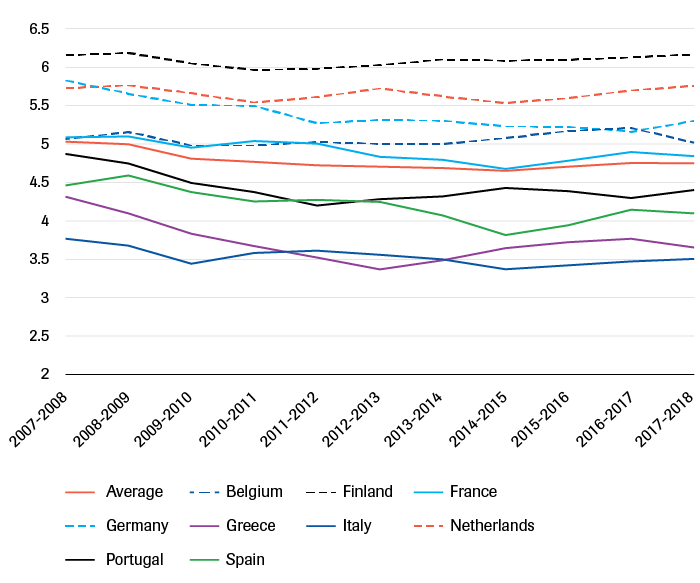

Quality of institutions

The quality of institutions (figure 1), the legal administrative framework in which individuals, firms and governments interact, is considered a strong determinant for the overall competitiveness of a country.[34] As main subcategories the GCI includes the level of property rights, ethics and corruption within public organization, judicial independence, but also overall public-sector performance such as government spending or regulatory burden. Private institutions through corporate culture are taken into consideration as well. To put the scores in a global context: in 2017-2018 Finland is the highest ranked country in the Eurozone and worldwide. Also the Netherlands (7th) and, to a lesser extent, Germany (21st), Belgium (25th) and France (31st) score relatively high in this category. Portugal (43rd), Spain (54th), Greece (89th) and Italy (95th) have the lowest score of the selected countries. All these countries, with Greece and Italy at the forefront, suffer from a particularly low public sector performance.

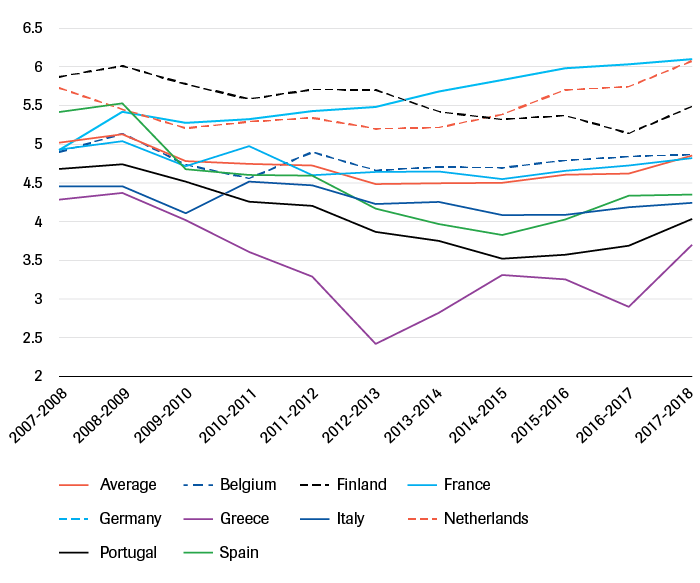

Macroeconomic environment

The macroeconomic environment (figure 2) looks at government budget balance, national savings and inflation, but also at government debts (and interest rates or credit ratings). As such it focusses more on the results of government policies and the (underlying health of) individual economies. Germany is the highest ranked country in the Eurozone and 12th worldwide; The Netherlands (14th) and Finland (33rd) too have a stable macroeconomic environment. Belgium (59th) and France (63rd) show average scores, mainly due to their relatively high public debts and their budget balances. Spain (90th), Italy (96th), Portugal (105th) and Greece (117th) score low on all subcategories concerning macroeconomic environment.

Internal market indicators

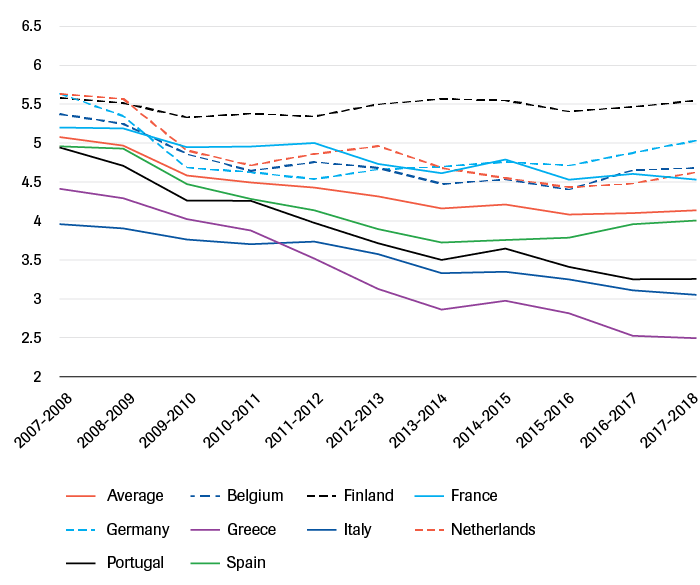

Financial market development

The financial market development (figure 3) indicates the efficiency of the financial sector. That includes financial availability or the transparency of the banking sector and appropriate regulation. Sub-indicators are based around efficiency (easy access, venture capital availability) and trustworthiness (regulation and legal rights/bankruptcy laws). Finland is the best performing country in the Eurozone and ranks 4th in the world. Germany (12th), Belgium (26th), the Netherlands (28th) and France (33rd) score relatively well, although none of them has recovered to pre-crisis levels. Although Spain’s (68th) situation is less dire, Portugal (116th), Italy (126th), Greece (133rd) all perform poorly, showing a severe reduction of their financial markets during the crisis.

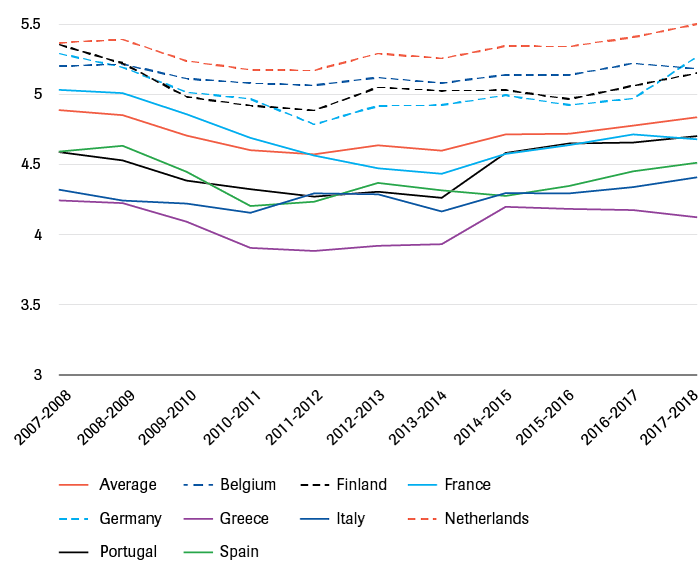

Goods market efficiency

Goods market efficiency (figure 4) can force companies, particularly in an open European market, to become more innovative and customer oriented and it, furthermore, imposes market discipline. Components the GCI looks at are domestic and foreign competition between companies (e.g. the existence of trade barriers), anti-monopoly policy, but also buyer sophistication. The Netherlands is the best performing in the Eurozone and ranked 5th in the world. Germany (11th), Belgium (16th) and Finland (17th) also score high. Portugal (34th) and France (36th) show relatively high scores in global comparison, with Spain (49th), Italy (60th) and Greece (93rd) slightly above or below the global average. Overall, the quality of demand (e.g. buyer sophistication) is high in all countries. In southern Eurozone countries the protection of incumbent companies is rather high, making market entry more difficult. Moreover, the competition of the market differs significantly in both domestic and foreign competition. This is contrary to the general principles underpinning the EU’s internal market.

Labour market efficiency

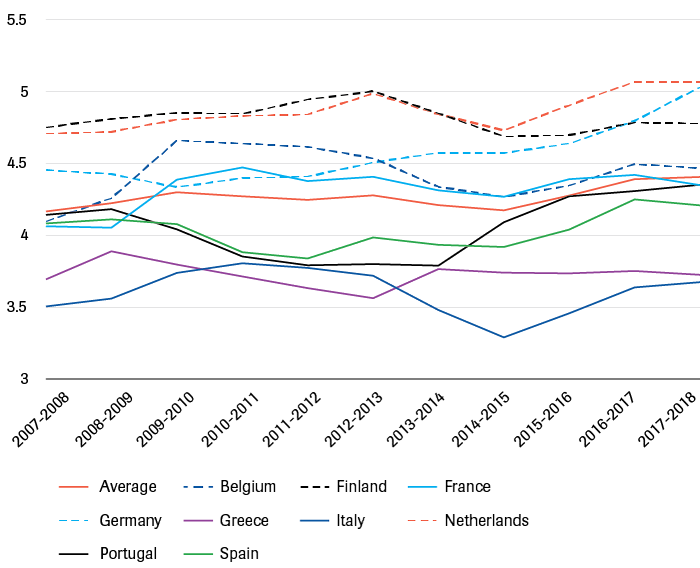

Labor market efficiency (figure 5) is critical to ensure workers are allocated to their most effective use in the economy. The GCI looks at the flexibility of the labour market (hiring and firing practices, wage flexibility, etc.) and the efficient use of talent, such as whether salaries reflect productivity and the related country’s capability to attract and retain talent. The Netherlands is the best performing country in the Eurozone and ranked 13th globally. Germany (14th) and Finland (23rd) score high as well. Belgium (44th), Portugal (55th), France (56th) and Spain (70th) continue to score above the global average, but Greece (110th) and Italy (116th) show significantly lower scores. All countries, with the exception of Greece and Italy, score rather well in their ‘efficient use of talent’; however, the flexibility of the selected countries’ labour markets is comparatively low.

Source: GCI, World Economic Forum. Adapted by author. 1 = lowest, 7 = highest.

Source: GCI, World Economic Forum. Adapted by author. 1 = lowest, 7 = highest.

Source: GCI, World Economic Forum. Adapted by author. 1 = lowest, 7 = highest.

Source: GCI, World Economic Forum. Adapted by author. 1 = lowest, 7 = highest.

Source: GCI, World Economic Forum. Adapted by author. 1 = lowest, 7 = highest.

Divergence between and within subgroups

Figures 1 to 5 show significant differences between the member states. In the specific categories both high-performers and low-performers can be identified. Striking is that in the different graphs three subgroups can be identified:

Literature on varieties of capitalism or administrative tradition literature have long identified these different (economic) institutions in countries. The persisting differences as well as the fact that overall, especially with regard to the quality of institutions, little progress is made in these categories seems to confirm the ‘stickiness’ of institutions and the difficulty to implement meaningful and lasting reforms. Table 1 shows the degree of convergence of the selected countries. In all categories the standard deviation has increased, indicating divergence. Particularly noticeable is the increased standard deviation in the financial market development, macroeconomic environment and the quality of institutions.

Red = divergence, Green = convergence.

| Quality of Institutions | Macroeconomic environment | Financial market development | Goods market efficiency | Labor market efficiency | |

|---|---|---|---|---|---|

| 2007 – 2008 | 0.7788953 | 0.5463647 | 0.5809693 | 0.4530902 | 0.4181672 |

| 2008 – 2009 | 0.8088458 | 0.5373515 | 0.5683274 | 0.4494555 | 0.3918233 |

| 2009 – 2010 | 0.8593052 | 0.5628758 | 0.498324 | 0.422011 | 0.4159464 |

| 2010 – 2011 | 0.8447559 | 0.6144045 | 0.5237073 | 0.463524 | 0.4594172 |

| 2011 – 2012 | 0.8652202 | 0.7327914 | 0.6190201 | 0.4329612 | 0.4987448 |

| 2012 – 2013 | 0.9184198 | 0.9900335 | 0.7696766 | 0.4686725 | 0.5361705 |

| 2013 – 2014 | 0.9163334 | 0.9043496 | 0.854405 | 0.4744394 | 0.4936456 |

| 2014 – 2015 | 0.918611 | 0.8840618 | 0.8249526 | 0.422442 | 0.4733083 |

| 2015 – 2016 | 0.9021409 | 0.949724 | 0.8230353 | 0.4002132 | 0.4663917 |

| 2016 – 2017 | 0.8919059 | 0.9794686 | 0.9599005 | 0.417297 | 0.4735015 |

| 2017 – 2018 | 0.9149495 | 0.8714584 | 1.009167 | 0.4586246 | 0.5017041 |

| Difference 2007 – 2017 EU-9 | + 0.1360542 | + 0.3250937 | + 0.4281977 | + 0.0055344 | + 0.0835369 |

| Difference 2007 – 2017 EU-28 | - 0.0009167 | - 0.2758253 | + 0.0845747 | + 0.067101 | - 0.0369428 |

Source: GCI, World Economic Forum. Computed by author.

In the macroeconomic environment the members of group 1 and group 3 respectively are becoming more similar, after having diverged in the crisis, and the gap between North and South in this aspect has widened. But when looking more in-depth at the overall data, there is not just a North-South divide, as is often portrayed.[36] Within the identified groups there is also divergence taking place. Regarding the quality of institutions, all the subgroups show divergence as well. In other words, Finland, the Netherlands and Germany, while having more similar performances, are diverging from each other as well. In the financial market as well as the goods and labour markets there is an overall divergence both among all the selected countries and within the subgroups. One exception is that group 1 appears to marginally converge in their labour markets, particularly noticeable are the similarities of Germany and the Netherlands in this. The data shows that on some core issues regarding the fundamental health of national economies through the quality of institutions and the macroeconomic environment (although improving), no convergence is taking place. Other important pillars of a well‑functioning monetary union, namely the basic framework to induce capital and labour mobility, also appears to have deteriorated and the markets remain highly fragmented or even underdeveloped.

On a final note, while convergence in a monetary union in the selected indicators is desirable by itself, it is more than noteworthy to mention that overall in the EU-28 the standard deviation of three of the five indicators has become smaller over the same period. This has a variety of factors (including the method) that cannot only be attributed to the EMU. For example, Eastern European countries (incl. the Euro countries such as the Baltics) have made significant progress on these areas in recent years. Nevertheless, the fact that for more than a decade the selected countries have shown little to no convergence, is a cause for concern. The different developments suggest that the current EMU multi-level institutional framework is not inducing convergence. Rather, other (domestic) factors might play a far more significant role that is worth exploring further.

Conclusion

This short contribution has set out to discuss the level of convergence in the Eurozone. The macroeconomic environment might have improved but the different institutions and economic structures continue on their divergent path, despite initiatives such as the European Semester and the Macroeconomic Imbalances Procedure. Claims are made that the Euro exacerbates the differences between North and South, but in general there appears to be no convergence within the North or South either. The differences and the diverging trends as discussed here seem to support the need to reform the EMU, but what kind of reforms? The political choices to overcome the economic and institutional differences, while aiming for a resilient Economic and Monetary Union, are mounting. The new reforms of the EMU as currently on the table appear to neglect, or avoid, the continuing divergence and seem to insufficiently address and analyze underlying problems: weak national institutions and fragmented, inefficient, capital and labor markets.

The establishment of a European minister of economy and finance and the establishment of a ‘European Monetary Fund’, besides the question of whether it’s politically attainable, could further complicate accountability and responsibility of what are fundamentally national economic problems.[37] In addition, it is unclear to what extent these initiatives will increase the resilience of the EMU. Member States need to continue to reform and address the fundamental health as well as openness of their capital and labor markets. Further reforms in the fragmented capital and labor markets should be on the table. The use of the EU budget and the enhancement of the Structural Reform Support Service to encourage and support the member states is a step forward. Yet, it does not tackle the continuing (political and institutional) differences and some fundamental national economic issues. To conclude, varieties of capitalism and administrative tradition literature might provide interesting venues for further exploration on (domestic) institutional change and the resilience of the EMU on the basis of convergence and competitive national economies. Three sets of questions might be particularly interesting and currently deserve more attention as to potentially help guide current discussions on EMU resilience.

About the authors

Yuri van Loon is a former research fellow at the Clingendael Institute, where he focussed on EU economic and financial affairs. He currently lectures at the faculty of governance and global affairs of Leiden University.