The paradox of a stronger global role for the euro

Adriaan Schout will present his position paper during the Round Table discussion for the Dutch House of Representatives Committee on Foreign Affairs on the 'Future of the euro’. Watch the livestream (in Dutch) on 13 February 2023, 14:00-18:00 hrs. He is participating in panel 4: The euro in an international (geopolitical) context (17:00-18:00).

On 9 March the plenary debate on the future of the Euro took place in the Dutch House of Representatives.

His position paper is based on his policy brief 'Scenarios for the eurozone: A realistic perspective between hopes and fears', co-authored with Daniel Gros of CEPS.

Scenarios for the euro and the global role for the euro

A stronger global role for the euro has been on the agenda since the first concepts of EMU. This contribution first covers the state of the discussion and subsequently points to the potential institutional implications of the geopolitical euro. The latter has received little attention in the literature.

There is fairly broad consensus among experts regarding the following points:

- In theory, an international role for the euro has some economic costs and benefits as well as some geopolitical advantages.

- The scope left to increase the global role for the euro is limited given the decreasing economic weight of the euro area (and its lack of hard power).

- The EU’s geopolitical power is to some extent a zero sum game (our win means somebody else’s loss). The main global geopolitical competition will be between the US and China. The question needs to be asked whether the EU should aspire to gain a greater role for the euro at the expense of the US or concentrate on close cooperation with the US.

- It is not clear what measures could deliver a substantially greater global role for the euro. A greater supply of eurobonds is often mentioned but a greater supply of AAA rated bonds in euro could be more quickly achieved through large Member States putting their fiscal house in order.

The paradox of a geopolitical euro follows from scenarios for the euro

- The Business As Usual (BAU) scenario in which member states regularly fight over economic governance, without arriving at a shared model for the euro, will not deliver the trust in the permanency in eurobonds that financial markets want.

- The Fiscal Union scenario is unlikely to happen. This scenario would have enormous institutional consequences (and impose stringent requirements on member states).

- The Minimum Model scenario assumes that member states understand that stability starts at home, accept the no-bail out, and agree that occasional crises may demand a flexible loan-based support mechanism to prevent a liquidity crisis from developing into a systemic crisis. This model is most feasible for a stable international currency but will result in insufficient eurobonds to support the ambition of the euro as a major international player.

The paradox of the euro as global currency is that the Minimum Model offers the best prospects for a stable euro even though it cannot offer sufficient economic cloud based on deliberately increasing the issuance of eurobonds.

In any case, the euro under the Minimum Model will be in greater demand than the current euro under Business As Usual. What the eurozone needs is nominal convergence (not so much real convergence).

The euro as global currency: well-deserved second place

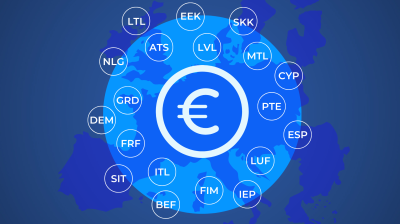

The euro already is a global reserve currency, second only to the USD. The most often mentioned metric is the share in foreign exchange holdings, which is 21 % for the euro, roughly one third of that of the USD (and equal to the sum of all other minor reserve currencies combined).

Currently, the eurozone accounts for about 15% of global trade, similar to that of the US – slightly less than when the euro was introduced. This fall in the share of the euro is due to the rise of China, not a fall in extra-euro area trade, which has remained strong. The share of the euro in foreign exchange transactions is roughly the same as its share in global trade, but only one third of that of the US. The Chinese renminbi is moving up from 4% in 2019 to 7% in 2022. The yuan thus remains far behind the euro although China is a greater trader than the euro area and the Chinese government is more forceful in promoting the renminbi as reserve currency (see the Belt and Road Initiative and the recent energy contracts with Saudi Arabia).

The increase in the shares of the other currencies over the last decades has come mainly at the expense of the USD, whose share has declined by over 10 percentage points since the financial crisis.5 The near constancy of the euro's share over more than 20 years and the rise of the rest suggests that there is little upside room for the euro (unless there is a run from the dollar but that might also imply a run away from the euro if for example the US and EU combine forces over sanctions). The motives of foreign exchange reserves holders, i.e. central banks all over the world in choosing the currency composition of their reserves are not well understood (economies of scale, routines, hedging risks, expectations, etc.).

We conclude that the space to expand the global currency role for the euro is limited.

- The ‘dominant currency paradigm’ implies that there are economies of scale in the choice of invoicing currencies.

Gopinath, G., Boz, E., Casas, C., Díez, F. J., Gourinchas, P. O. and Plagborg-Møller, M. (2020), ‘Dominant currency paradigm’, American Economic Review, 110(3), 677-719. Once a large part of exporters has converged on the use of the US dollar it does not make sense for them to switch to the euro because many of their trading partners are using the US dollar and because financial markets are much more developed in dollars. - The share of the eurozone in global trade is likely to fall further due to the increase of other players.

- The euro area financial markets (for traded securities) are much smaller and less liquid than those of the US – and are likely to remain so as the EU’s capital market union makes little progress.

- Extending the supply of AAA rated securities in euro might help; but remains unlikely if the fiscal position of large Member States like France deteriorates and the supply of Eurobond is unlikely to increase much beyond the financing of the current NGEU. Moreover, covering EU ambitions via eurobonds will have major institutional consequences for which there is limited support.

This many disappoint those with high hopes for the euro as global currency. Yet, in a multi-polar economy, a balance between the major currencies has advantages as no one has the power to fundamentally manipulate the exchange rate.

Is a stronger global role for the euro desirable?

Capital flows in and out of the euro area might become more volatile if the euro’s importance as a global currency were to increase. This was also the reason why the Bundesbank did not actively encourage the international use of the DMark.

One may doubt the advantages if China were to peg to the euro (instead of the USD or a basket).

Alleged advantages

Seigniorage: The euro and the dollar are already now about equal in terms of the amount of banknotes circulating abroad (the base for the classical notion of seigniorage) relative to their GDPs: both 5% of GDP. Estimates for the US are that approximately one half of all dollar notes (worth about $1.100 billion out of a total supply of dollars of $2.300 billion) and about 30-50 % of the euro cash supply (€500 to 750 billion) is held abroad.

Moreover, a global reserve currency status is supposed to bring lower interest rates. But US interest rates have on average over the last 20 years been slightly higher than those in the euro area (suggesting that the SGP has been quite effective preventing fiscal profligacy like that of the US).

Institutional consequences

The discussion on the international role of the euro has to be seen in connection to the institutional consequences. To a large extent, the current rejuvenation of the geopolitical euro relates to the ambitions of the EU (EU Commission and some Member States such as France) to be a geopolitical actor.

Also the discussion on eurobonds and the related continuation of NGEU is linked to the geopolitical role of the euro. Some argue that a stronger global role will demand a sizeable amount of eurobonds. But large issuance of eurobonds would have implications for the Treaty (allowing debts), EU taxation and the related consequences for the EU commission and European Parliament.

Many ideas have been going around to strengthen the economic governance of the eurozone. Some ideas concern wider tasks for the ECB e.g. in supporting energy transition or CO2 reduction through its asset purchasing programs. Although such suggestions would trigger major institutional questions

Related to a potential contribution of the ECB to creating safe assets to broaden the attractiveness of the euro would be if the ECB were to issue AAA rated and highly liquid assets. Such ECB Certificates of Deposit would be extremely safe and liquid, and would be interesting for banks and for Central Banks. If the ECB were to issue permanently large amounts of these instruments it would become a large financial intermediary which might require major institutional reforms related to fundamental questions such as: who decides on the amount of ECB certificates of deposits to be issued? Would that be the Board of Governors, or the ministers of finance? Moreover, what will the ECB do with the money that it receives in return - e.g. invest in green transition, buy government bonds, or lend to banks?

The euro has a role as international currency that is stable as well as more or less in proportion to the weight of the economy of the eurozone. Further steps can be taken to stimulate its international use. However, it is unlikely that EU measures could lead to a significant jump in the global importance of the euro and it is not clear what benefits would result.

The best way to support the global role of the euro might be to work towards the Minimum Model for economic governance in the eurozone. The Minimum Model in the end will result in a stable euro and demands little in terms of continuous solidarity or transfers (other than a flexible funds to address occasional crises).